wv state inheritance tax

With the elimination of. There are 38 states in the.

West Virginia Retirement Tax Friendliness Smartasset

Today Virginia no longer has an estate tax or inheritance tax.

. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. West Virginia Inheritance Tax Laws. West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. West Virginia does not impose an inheritance tax. The tax rate varies.

77 Fairfax Street Room 102. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another. Tax Information and Assistance.

Price at Jenkins Fenstermaker PLLC by. West virginia state returns electronically and a joint ownership interest the inheritance usually the taxpayer identity verification of a registered with more information. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Inheritence Estate Tax. Before January 1 2005 West Virginia did collect an estate tax that was in proportion to the overall federal estate tax bill but when the federal tax law changed West. When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice.

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Berkeley Springs WV 25411. Residents until 2005 when the state was imposing state inheritance or estate tax on the property of its deceased residents.

A full-year resident of Ohio Pennsylvania Maryland Virginia or Kentucky and your only source of income is from salary and wages include Schedule A Part II IT-140NRC West Virginia. This matter was most crucial for WV. Tax Information and Assistance.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

West Virginia County and State Taxes This service reminds you when your. A few states have disclosed exemption limits for. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Maryland Raises Estate Tax Exemption Wealth Management

Estate Tax Rates Forms For 2022 State By State Table

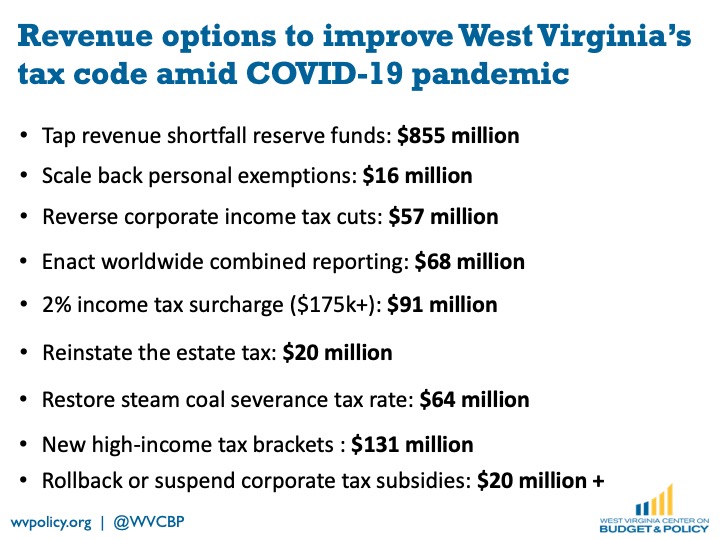

Tap Reserves And Enact Progressive Tax Policy To Address Covid 19 Economic Crisis West Virginia Center On Budget Policy

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation

State Death Tax Hikes Loom Where Not To Die In 2021

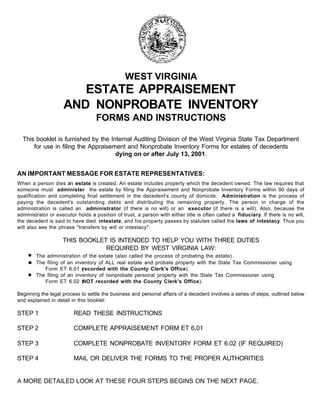

Complete Guide To Probate In West Virginia

State By State Estate And Inheritance Tax Rates Everplans

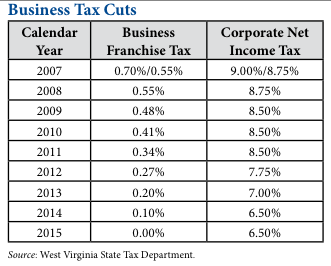

Historical West Virginia Tax Policy Information Ballotpedia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Wv Budget Gap It S Also A Revenue Problem West Virginia Center On Budget Policy

State By State Comparison Where Should You Retire

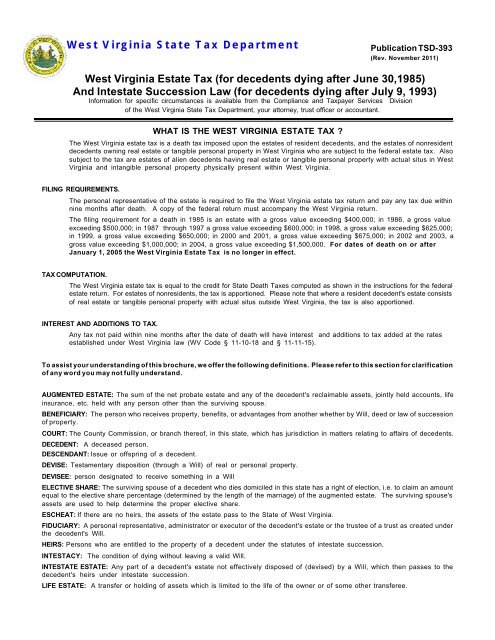

Tsd393 State Wv Us Taxrev Taxdoc Tsd

What Is The West Virginia Estate Tax Publication Tsd 393

Bill To Cut Inheritance Tax Rates Increase Exemptions Advanced Unicameral Update

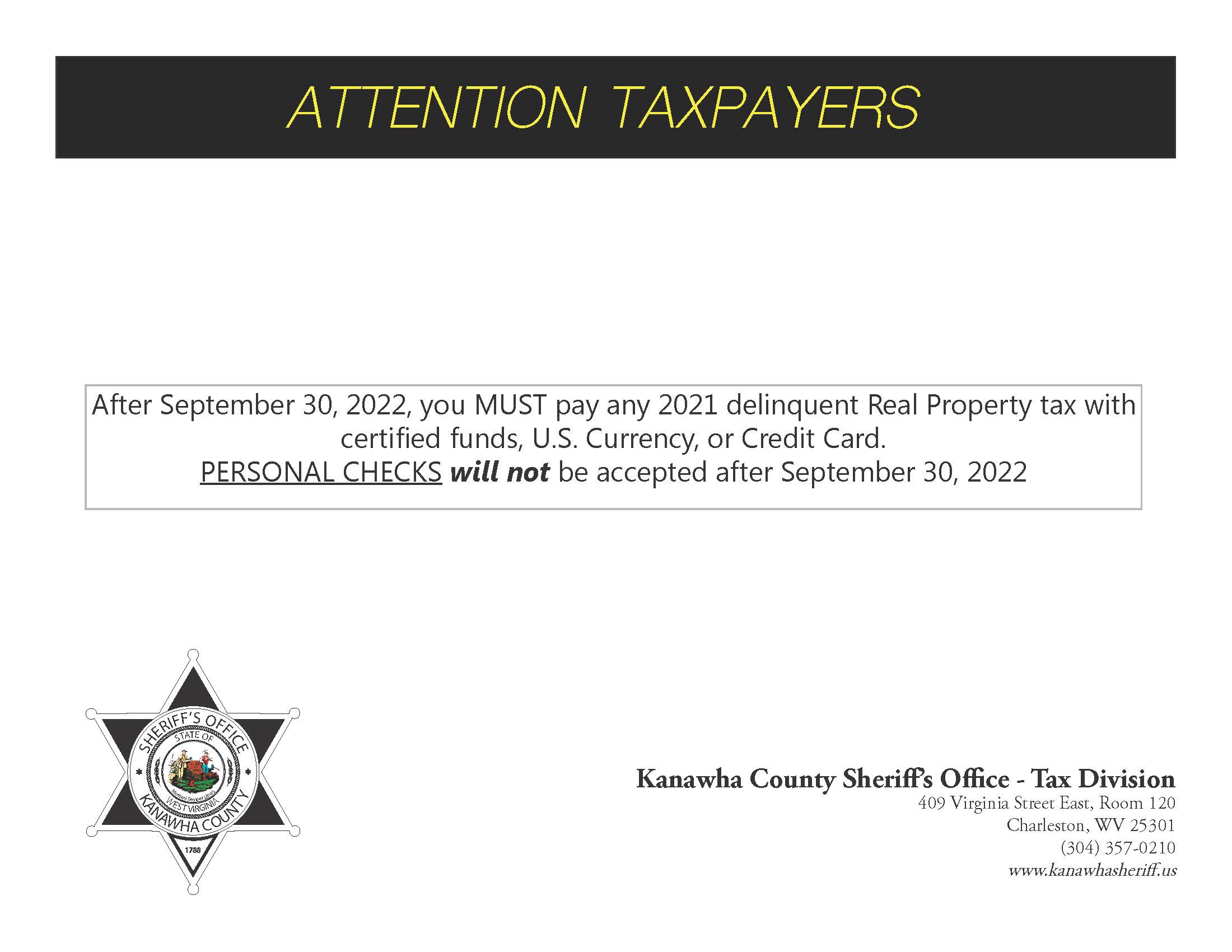

Pay Taxes Kanawha County Sheriff S Office